Uncertainty surrounds the future of Wiggle Chain Reaction after its business partners were sent an email, seen by BikeRadar, stating the company will file for insolvency.

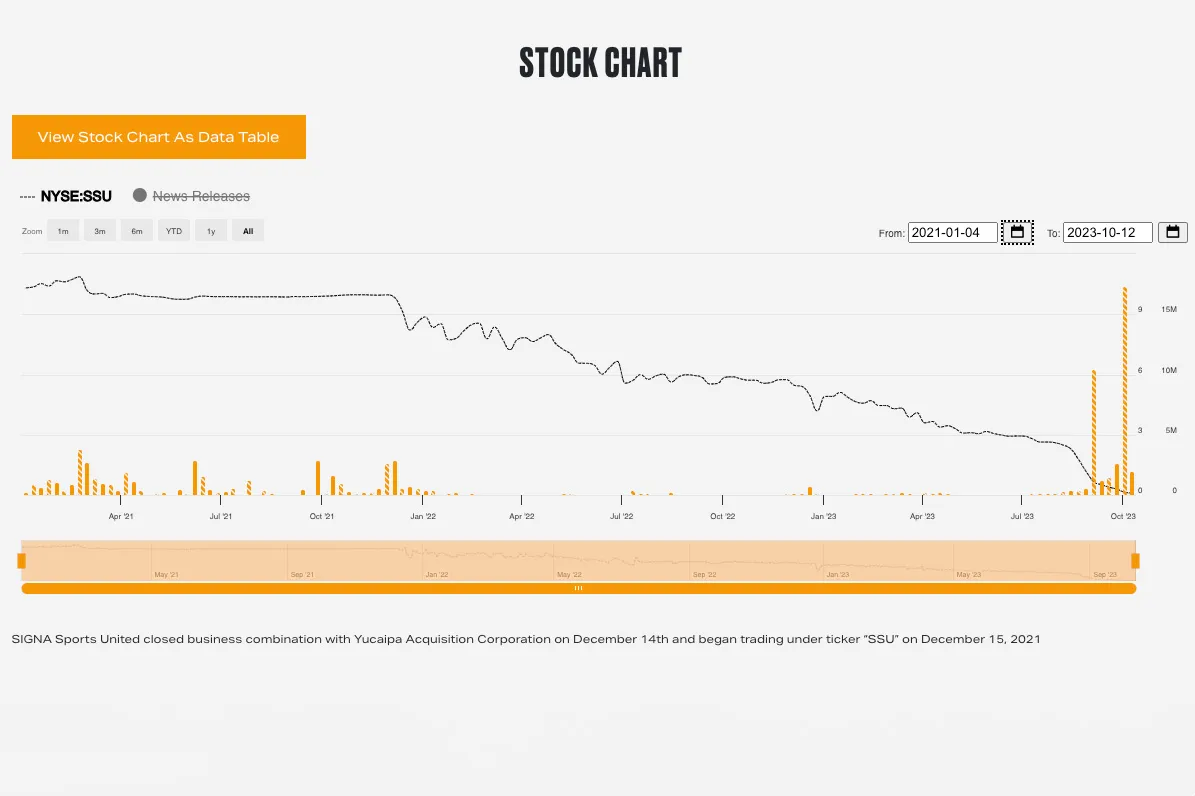

Wiggle Chain Reaction's future has been thrown into doubt after a period of turmoil for owner, Signa Sports United. Earlier this month, Signa Sports United (SSU) announced an intention to restructure and delist from the New York Stock Exchange as the sports e-commerce company faced “severe liquidity and profitability challenges”.

This was followed by news that Signa Holdings, an affiliate company of SSU, had terminated its unconditional €150 million Equity Commitment to SSU.

The decision to terminate the commitment was described by SSU as “unjustified” and put the company in an exceedingly difficult position, the fallout of which appears to have affected Wiggle CRC.

The email sent to Wiggle CRC's business partners explains: "Due to these circumstances, we are forced to go to court and file for insolvency, in particular an application for self-administration."

What happened?

SSU’s decision to restructure and delist from the stock exchange came after the company noted a continued lag in demand for its products in the first nine months of 2023.

In a statement published on its website, SSU said: “Although some economic indicators across core markets have continued to improve slightly, the demand for the Company’s products remains significantly below 2022 and pre-pandemic levels.”

As a result, SSU said it would begin to evaluate its operating model, which it said would include the “termination or winding down of non-performing assets… to strengthen the company‘s distressed liquidity position and financial profile”.

Wiggle CRC appears to fall into the category of non-performing assets. The email seen by BikeRadar suggests the company will file for insolvency following the withdrawal of the committed unconditional funding by Signa. However, speculation remains around whether this will happen.

The news comes after SSU acquired the company in December 2021.

The acquisition, which came around the same time SSU began trading, saw the company settle £312.9 million of Wiggle CRC’s external shareholder and bank debt.

Wiggle Limted’s annual report and financial statements for the year ended 30 September 2022 reveal the business recorded a pre-tax loss of just over £97 million.

The company generated more than £252 million in revenue, with 38 per cent of revenues coming from international territories outside of the UK.

The annual report says the business benefited from the pandemic lockdowns, particularly through 2020 and 2021.

While sales were down 32 per cent in the year to September 2022 due to the reduction in this benefit, they were still up 7 per cent compared to the year to September 2019.

However, international sales declined by 26 per cent in the same period, with Wiggle CRC citing the impact of Brexit reducing sales into the EU “where higher duty and fulfilment costs” necessitated higher pricing.

The report also stated the difficulty questions around the economy posed.

“The effects of the current economic uncertainty have been felt throughout the retail industry in recent months and the future impact of these uncertainties remains difficult to predict,” wrote Wiggle’s chief finance officer Adrian Bruce, who left the company in May 2023.

Who is Signa Sports United?

Signa Sports United is a global sports e-commerce specialist company with its headquarters in Berlin.

The company owns businesses covering cycling, tennis and outdoor sports, and has partnerships with more than 1,000 brands.

It has more than 80 online sites and partners with 500 shops serving a claimed 6.7 million customers worldwide.

Alongside Wiggle CRC, the Signa Sports United group includes Tennis-Point, Tennis Pro, Tennis Express, Fahrrad.de, Bikester, Probikeshop, Campz, Addnature and Outfitter.

The company also owns the mountain bike brand Nukeproof and the road bike and gravel bike brand Vitus.

BikeRadar reached out to Wiggle CRC for comment but it had not responded at the time of publishing.